KNSL: Kinsale Capital Group

Preface

Credits to Slow Compounding for providing many of the information below. Recommend a read for a really deep dive:

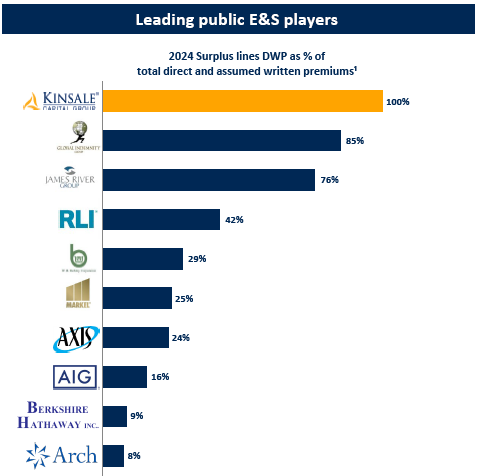

We wrote about the Excess & Surplus industry before, this post will focus on KNSL which is an 100% E&S pure-play insurer.

History

KNSL was founded only recently in 2009 by founder Michael Patrick Kehoe who was the CEO at James River Insurance. He realized that James River was not in good shape and left to built KNSL.

Capitalizing the turmoil of 2008/09 GFC, the original business model of KNSL revolved around providing customized insurance products exclusively within the E&S market. KNSL sought to distinguish itself through disciplined underwriting practices, a lean operational structure, and the strategic application of technology and data analytics.

The name “Kinsale” was inspired by a coastal town in Virginia, reflecting a connection to its origins and Michael Kehoe's vision. Many early employees brought decades of experience from other E&S insurance companies, contributing to a cohesive and experienced management team from the outset.

On February 2010, they acquired American Health Specialty Insurance and changed its name to Kinsale Insurance Company which underwrites the group’s E&S business.

KNSL is still managed by its founder Michael Kehoe, who serves as a CEO and Chairman. Originally the company was registered in Bermuda and subsequently re-domesticated to Delaware prior to its IPO in 2016.

Over time, KNSL has added a small number of specialized subsidiaries:

Aspera Insurance Services (2013) operates as their own wholesale broker with licenses in more than half of the US states.

Kinsale Real Estate and 2001 Maywill (2018) were created for investment property purposes.

Today, KNSL is a pure-play insurer in the E&S space focusing on small and mid-sized commercial risks in the US. It doesn’t operate outside the US and doesn’t own any retail broker network.

Business Model

KNSL writes a broad array of insurance coverages for risks that are unique or hard to place in the standard insurance market. Typical E&S risks include newly established companies or industries, high-risk operations, litigious venues, or companies with poor loss histories.

KNSL underwriters specialize in individual lines of business which allow them to develop in-depth knowledge and experience of the risks they underwrite. Their core client focus is small to medium-sized accounts, which tend to be subject to less competition and have better pricing.

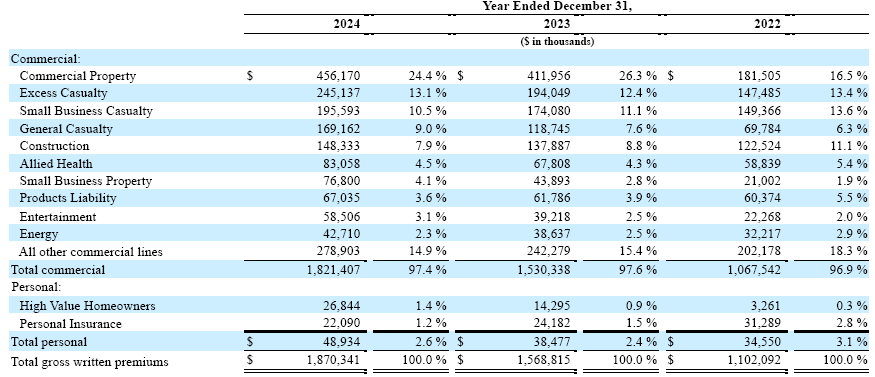

Over the years, the mix of casualty premiums have decreased from 94% to 67%, the remainder is property risks.

On the property side, KNSL writes for small business property for manufacturing, hospitality, retail, entertainment venues and other occupancies with elevated risk characteristics. It also writes homeowners’ policies in catastrophe-exposed areas and high-value homeowners’ coverage above $1 million.

We can see the concentration of premiums in natural catastrophe-exposed states like California (18.8%) and Florida (15.6%).

The casualty portfolio consists of liabilities like construction, liquor and product liability for a wide range of consumer and industrial products. Below is the breakdown:

How KNSL Succeed

The recipe to win in the insurance industry is well-known:

Underwrite profitably.

Be a low cost producer.

Large Number of Submissions

What is unique about KNSL is how they use technology to filter through a large number of submissions and only select a small fraction of business to underwrite. They are able to do this because of two structural advantages from which they built KNSL right from the start:

Proprietary data.

Technology stack that was built from inception without legacy baggage.

To illustrate how KNSL rejects a large number of submissions: In 2024, KNSL received ~881,000 submissions for new policies. About 590,000 quotations went out but only 64,000 policies went into KNSL books. That’s a 7% conversion rate. The underwriting department only has 330 employees, there is no way these people are looking through these policies by hand.

So, to achieve this KNSL uses their proprietary tech to drive a high level of efficiency, accuracy and speed in the underwriting and quoting process on complex and unusual risks where other insurers reject, either due to insignificant size or incapability to underwrite. The result is a high retention rate and therefore lower cost of acquisition. Most of KNSL policies are on 1-year period and management states that 66—75% of expiring policies are renewed.

Claims Process

KNSL claims department has only 90 employees, they have an average of 9 years of claims experience. The Chief Claims Officer, Mark Beachy, has 30+ years experience in large commercial insurance. KNSL manages all claims themselves, there’s no delegation to third parties and the claims department is fully integrated with other functional departments.

The process of claims adjusting allows for greater supervision over the adjusting process by extending low reserve and settlement authority levels to front-line claim examiners. This keeps the adjuster-to-supervisor ratio low, ensuring that two or more claims employees participate in the decision making process. Their claim examiners also work closely with underwriting staff to keep them updated of claim trends.

Technology

The IT department actually has more employees than claims at 130 people. The Chief Information Officer, Diane Schnupp, joined recently in 2019 and was promoted to her position in 2021.

As a relatively young company, KNSL was able to build its own technology platform from the ground up. It operates on an integrated digital platform supported by a data warehouse that captures a wide range of underwriting, claims and financial data. The goal is straightforward: maximise efficiency, accuracy and speed in the core processes of submission intake, rating, quoting, binding, policy issuance and claims handling.

We designed the architecture for our information systems in a fashion that would allow us to reduce our administrative costs and quickly provide us with useful information. Our insurance company subsidiary operates in a digital environment, which reduces the costs of printing, storing and handling thousands of documents each week. Moreover, by maintaining electronic files on each account, we have been able to facilitate clear communication among personnel responsible for handling matters related to underwriting, servicing and claims as each has access to the necessary information regarding an account.

KNSL initial solutions were not burdened by legacy systems, unlike many big insurance companies due to different legacy and third-party systems that don’t communicate well. Two factors helped KNSL reduce the expense ratio:

Tech platform was built from scratch.

Systems were built in-house.

According to management, it took about 7 years to fully develop their software environment. They don’t have legacy software, owns all their data, and maintains full control, while many competitors are forced to integrate third-party solutions into their technology platforms because they do not handle everything in-house.

KNSL is centralized, with a simple organizational structure that does not include multiple insurance subsidiaries. Since the company does not engage in M&A, there are no integrations required that could complicate the software architecture.

Brokers who bring business love to be able to close deals quickly. A competitive advantage arises from faster turnaround time for providing quotes. The quick response time allowed KNSL to negotiate for low commission rates, driving down expense ratios.

In today’s market, the capabilities within the insurtech market have improved significantly. However, KNSL technology edge is defensible because even if competitors adopt sophisticated solutions, there is always the risk of not owning the solution. They may be quick to start and get operational, but from a long-term strategic lens they will be beholden to vendors who are also servicing other competitors. If everyone uses third-party solutions, then who has the competitive edge?

Combined Ratio

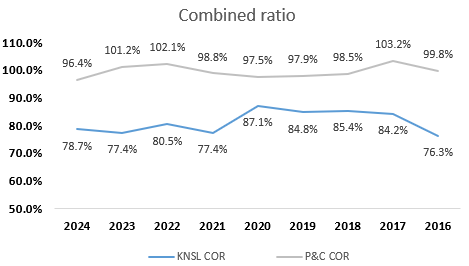

Unfortunately, there is no disclosure on how exactly their technology works. However, as outsiders we can observe the long-run results of KNSL operation excellence through the combined ratio.

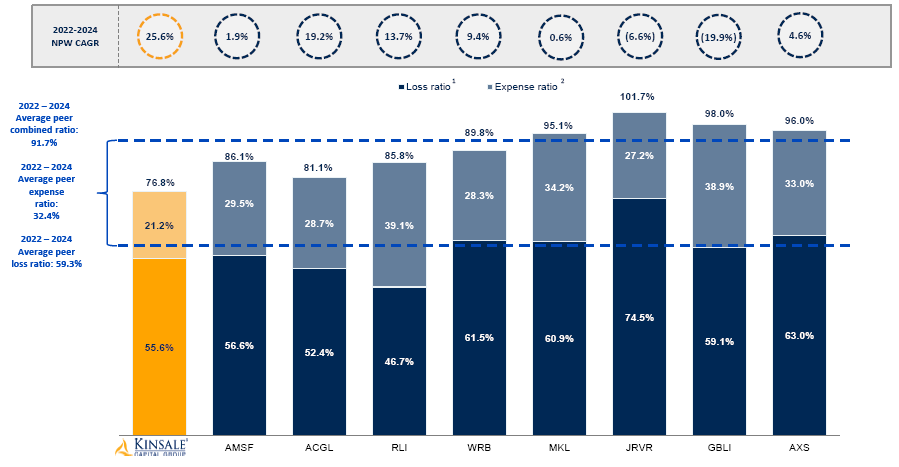

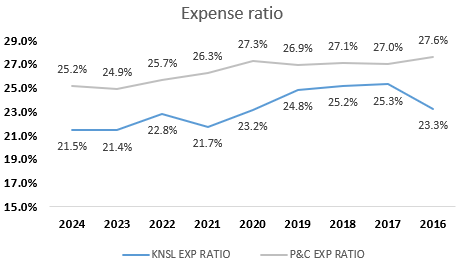

First, KNSL is indeed a low cost producer. Across years 2022 — 2024, the average peer expense ratio is 32.4%, KNSL reports 21.2%, this is the lowest amongst competitors:

The overall P&C industry trend since 2016 is also improving. KNSL has ~4 percentage points expense advantage against the average insurer:

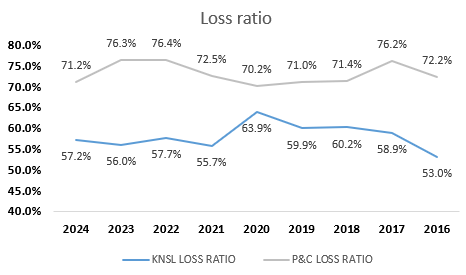

Second, on loss ratios we can compare KNSL with the broader P&C industry but it is not suitable to compare across peers. Because loss ratios are directly affected by loss reserving cultures that are different for everybody.

The ideal goal is to accurately reserve for future claims development, but obviously nobody knows the future, so some insurers are conservative while others are not.

For this reason, we compare KNSL loss ratio against the P&C industry:

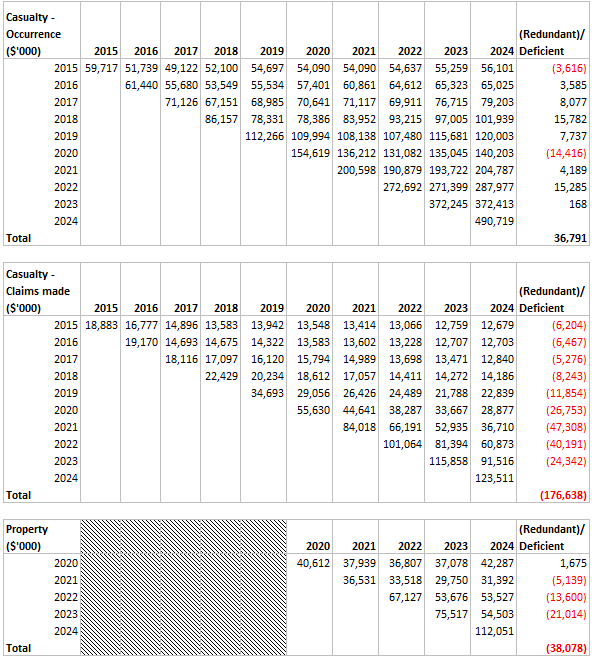

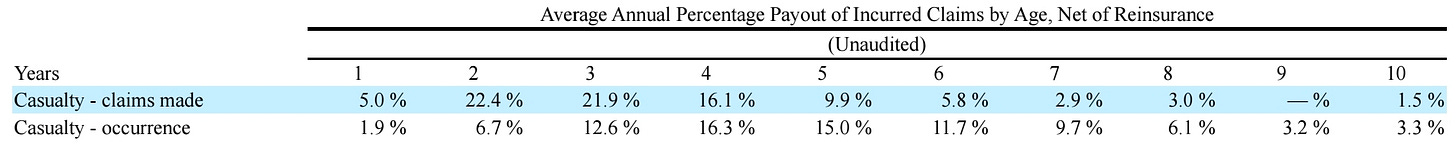

To get a sense of KNSL reserving culture, we can check the claims development triangle. This shows how the initial reserve estimate for any given accident year evolves through time. We prefer reserves to be redundant rather than deficient:

Putting together, we can see KNSL has an excellent record of profitability within the P&C industry that on average produced just 0.5% underwriting margins:

Investment Portfolio

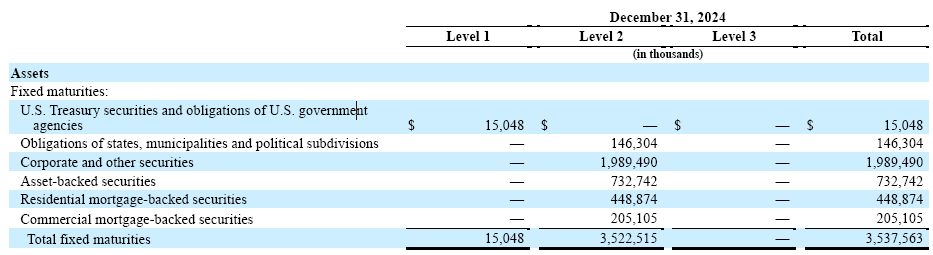

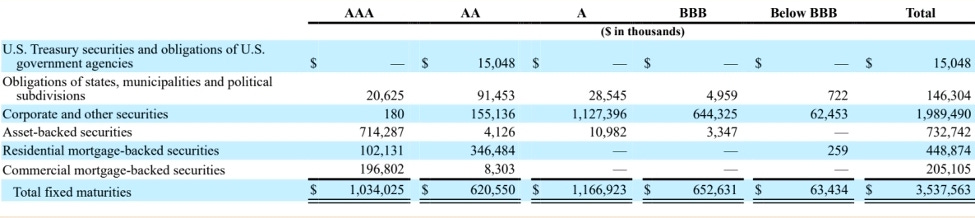

KNSL invests the insurance float into fixed-income securities, mainly corporate bonds:

The credit ratings are only 46% high-quality (AAA, AA). Rating A denote expectations of low default risk. The capacity for payment of financial commitments is considered strong. This may be more vulnerable to adverse business or economic conditions than is the case for higher ratings.

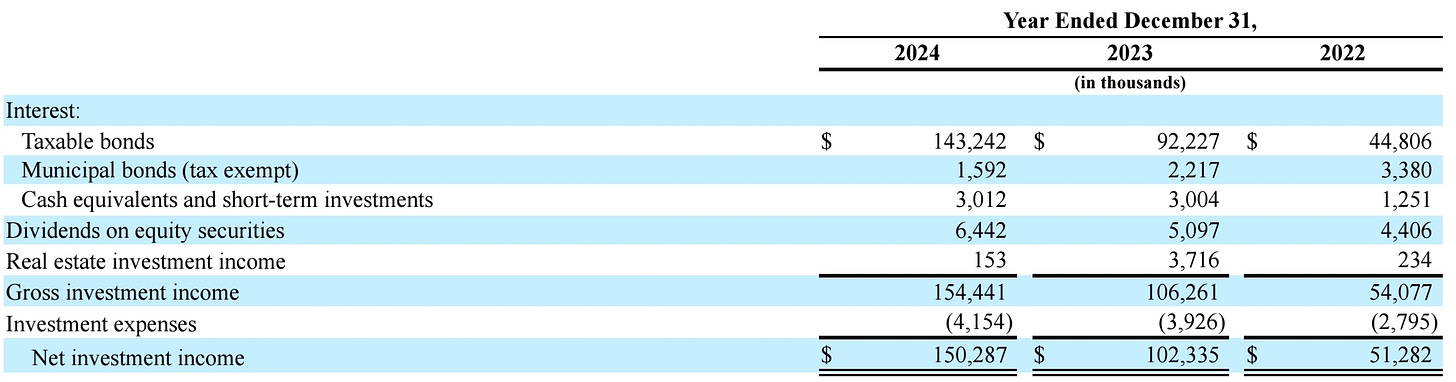

In 2024, interest income and real estate produced $149m (yield 4.2%):

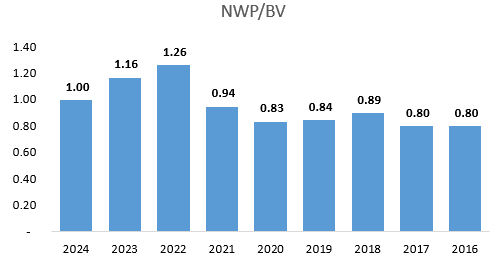

This strategy makes sense as it only has $1.5b equity capital while historically writing premiums at an average leverage ratio 0.95x to equity. We can see as the hard market came in 2019, KNSL ramped up growth and slowed down to 0.9x in Q3 2025 as pricing softens:

Given that KNSL does complex risks with long-tails, it makes sense that underwriting leverage is kept low and regulators will not allow KNSL to hold risky assets backing insurance liabilities.

Therefore, smaller allocations to equities, real estate and other asset classes provide some additional return potential but remain modest relative to the fixed-income book.

Long Tail Risk

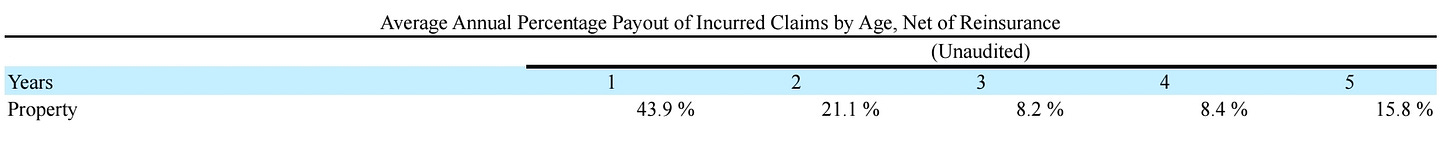

A downside to the business model of underwriting unusual/complex risks is that KNSL holds long tail risks. Property claims incurred only mature to 84% by year 4 and casualty claims can stretch up to 9 years before being 95% mature:

This is the largest unknown that investors have to bear. In the insurance business there are no good surprises. Classic example is asbestos risk where large lawsuits emerge decades later accusing products for liability. KNSL does write asbestos and environment risk like chemical pollution which have the potential to turn into large allegations in the far future.

Brokers Network

The broker network comprising ~200 brokers at the end of 2024 has expanded over time, but there is still meaningful concentration among the largest producers. The single largest broker, RSG Specialty, accounts for around 20% of GWP. The top 5 brokers together place more than 60% of business.

This concentration is not unusual in the E&S market, where a handful of large wholesale intermediaries dominate distribution. Although it does create a degree of supplier concentration risk.

To manage this risk, KNSL upholds their reputation to be able to quickly turnaround quotes to brokers. From a broker’s perspective, they are intermediaries matching policyholders to insurers. All things equal, the faster demand can be matched with supply, the more commissions a broker can earn.

Incentives & Ownerships

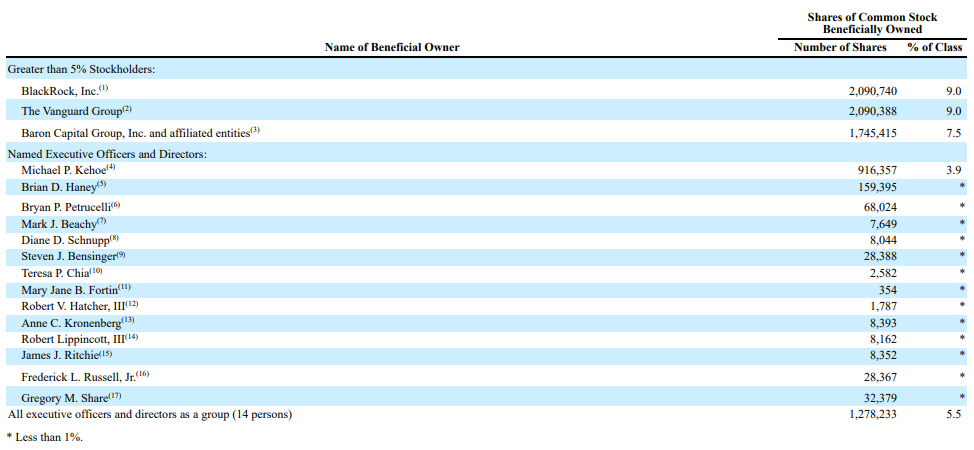

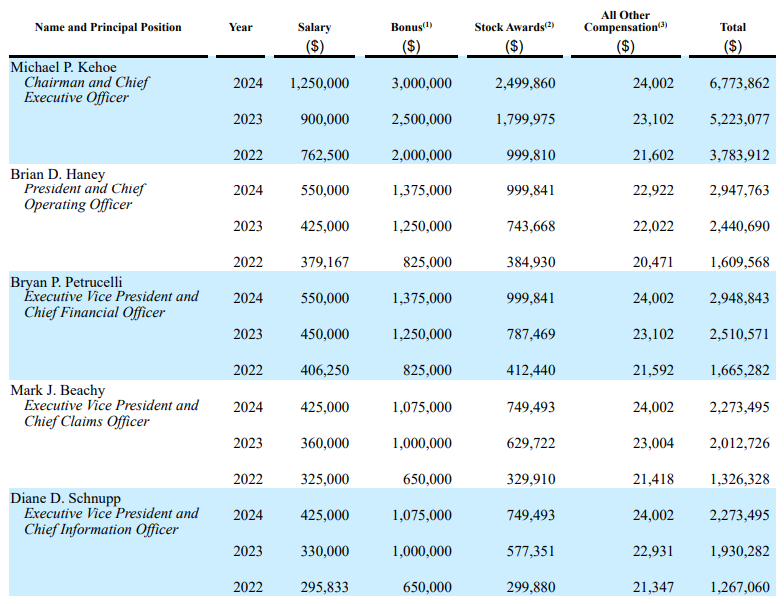

Michael Kehoe owns 3.9% and insiders own 5.5%. This is a large multiple compared to salaries and bonuses:

The metrics that determine compensation are (2025 proxy, pg. 33):

Actual underwriting profit (incl. fee income)

Combined ratio

Operating ROE (excl. FV, incl. net realized gains/loss)

AI Impact

On 8 Jan 2026, KNSL held an Investor Day outlining its strategy.

Management highlighted continued product expansion, including new offerings rolled out in 2025 and planned appetite and product extensions in areas such as homeowners, as well as targeted efficiency gains and specialization to support further growth in 2026.

They stressed service as a key competitive advantage, citing rapid quote turnaround, AI-driven submission routing, and a tightly managed wholesale distribution network. KNSL is on a tech stack improvement plan to integrate AI, their progress is about 2/3 done. They also showcased its claims and technology capabilities, including a specialized, non-delegated claims organization supported by proprietary platforms, advanced analytics, and selective use of AI.

Other Notes

KNSL has net operating losses (NOL) of $186.9m available to offset future taxes and begin expiring in 2029.

KNSL appoints an independent actuary once a year to perform an external review of reserve adequacy. This actuary is not involved in setting or recording the reserves. The consulting firm prepares its own estimate of loss reserves, and KNSL then compares this independent estimate with their own reserves to obtain further assurance about their adequacy.

Valuation

There’s plenty room for growth, KNSL has only 1.4% market share in the fragmented E&S market. Management doesn’t provide guidance but acknowledges that as the current hard market goes away, growth must slow down to protect underwriting profits.

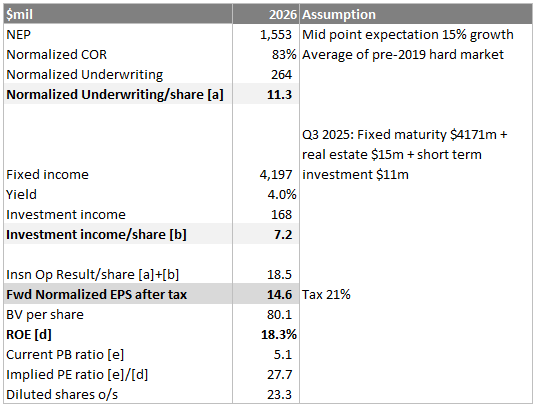

Clearly, the stock is not cheap against this background. We think the 1-year forward earnings normalized for soft market conditions is giving ROE of 18%. Against a current PB ratio of 5x, the implied PE ratio is 28x.

If we take another view that float acts like equity capital because when KNSL underwrites profitably and float doesn’t shrink, then incoming premiums can pay outgoing claims. Although float is an accounting liability, but economically speaking it’s like permanent capital.

Therefore, if we add the statutory capital of $1.5b (2024) to float of $3b (Q3 2025), we get $4.5b against current market cap of $9.4b, it’s still not cheap at 2.1x multiple.

We don’t have a good peer comparisons because no other large insurer is purely E&S, but if we look to WRB and Markel, KNSL multiples are at least twice as high. A possible explanation could be the growth and profitability profile is better for KNSL.

Conclusion

The situation with KNSL is simple: we have a strong underwriting engine but we have no idea if there’s any fat tail risks are hiding in those computer assisted underwriting. So far the results have been good since IPO in 2016.

If KNSL can really do 15–20% ROE during soft markets and 30% during hard markets, then we have a compounder and should pay up for quality.

We hope that the coming soft market causes short term pessimism. For now let’s wait and see.

I enjoyed reading the article, thank you. It resonates with my own views on the company.