Study: Excess & Surplus (E&S) Insurance

Intro

The US insurance market is broadly segregated into “admitted” and “non-admitted”. The admitted market is where products are standardized, for example, auto insurance. On the other hand, non-admitted (or Excess & Surplus: E&S) deals with risks that the admitted market cannot accommodate.

The insurers in admitted markets operate with products that have a long history of well-understood loss patterns, hence underwriting is straightforward and insurance clauses are standard.

E&S has unusual risks that are difficult to measure and/or too large in size, for example, prize indemnity insurance covers promoters who put up large value lucky draws by allowing them to transfer the risk of payout to the insurance company.

Regulators created E&S laws where pricing and policy design are much more flexible, but where policyholders do not enjoy the same level of regulatory protection.

To properly price these unusual risks, E&S insurers cannot be forced into a fixed policy format and pricing. For insurers to be profitable, they are allowed freedom of rate and form, meaning they can price and structure individual risks independently without requiring rate adjustments to be approved by regulatory authorities.

The insured events in E&S are not necessarily more risky than admitted markets, but they are more difficult to accurately assess. Being more complex means that E&S insurers who have underwriting experience, data and discipline usually possess a competitive advantage.

Types of Policies

Risks that end up in the E&S market are diverse, but they can be categorized into these few buckets.

New or Rapidly Changing Risk

Economic and technological progress constantly creates new business models and new exposures. Cyber risk is a good example, as more commerce and data move online, companies need coverage for data breaches, business interruption due to cyber attacks and liability for privacy violations.

Before 2010, cyber risk were covered by E&S markets with AIG being the first to provide coverage in 1997 despite having no actuarial data. This risk class only moved to admitted markets in early 2010s.

Another example is hurricane windstorm risk in Florida is written in the E&S market. The state is plagued with hurricanes and admitted insurers have historically avoided this market, causing Florida to be the most expensive state to buy homeowner's insurance.

Large/Concentrated Risk

Very large or concentrated risks can exceed the capacity of admitted markets. For example, large industrial plants, chemical facilities or energy projects can cause huge losses when catastrophe happens. Admitted insurers may not be willing to take on that level of exposure under their usual rate and form constraints, especially if the risk is highly specialized.

Unusual Risk

There are risks that don't occur very often, for example, Markel writes insurance for summer camps. Because data is limited, admitted insurers have no experience to underwrite.

The policyholder can also present unusual risk characteristics. For example, Berkshire once covered Mike Tyson's life when he was a professional boxer.

Type Of Distributors

Sitting between the policyholders and insurers are the following distribution channels.

The compensation earned by these channels is a direct cost item for insurers and end up in the expense ratio.

Captive Agents

They work exclusively for a single insurance company and sell only that company’s products. They are either directly employed or contractually tied, which means they do not offer competing products.

This setup gives them deep familiarity with their own company’s offerings and access to extensive training and support, often backed by a strong brand.

The trade-off is a limited product range, which may not always be the most competitive option.

Captive agents are typically compensated through commissions on the business they place.

Wholesale Brokers

They act as intermediaries between retail brokers and insurance companies and do not interact directly with policyholders. Wholesale brokers give retail brokers access to E&S markets that would otherwise be out of reach, using their expertise and relationships with insurers to help structure and place coverage for complex risks.

The wholesale broker knows which specialty insurers might be interested in a given risk and how to structure the placement.

They are typically compensated with commissions (usually % of premiums) by the insurers with whom they place business.

Managing General Agents (MGAs), Managing General Underwriters (MGUs)

These are specialized intermediaries with delegated authority from insurers. They can underwrite, bind coverage and sometimes handle claims on behalf of one or more insurers. In effect, they are outsourced underwriting offices for specific niches or regions.

This model can be powerful for reaching fragmented markets, but it also introduces another layer of economics and potential misalignment: MGAs are often paid based on premium volume, while the insurer bears the ultimate underwriting risk.

MGUs typically do not handle broader administrative tasks or claims management. Instead, their work is concentrated on underwriting and risk evaluation processes.

Industry Characteristics

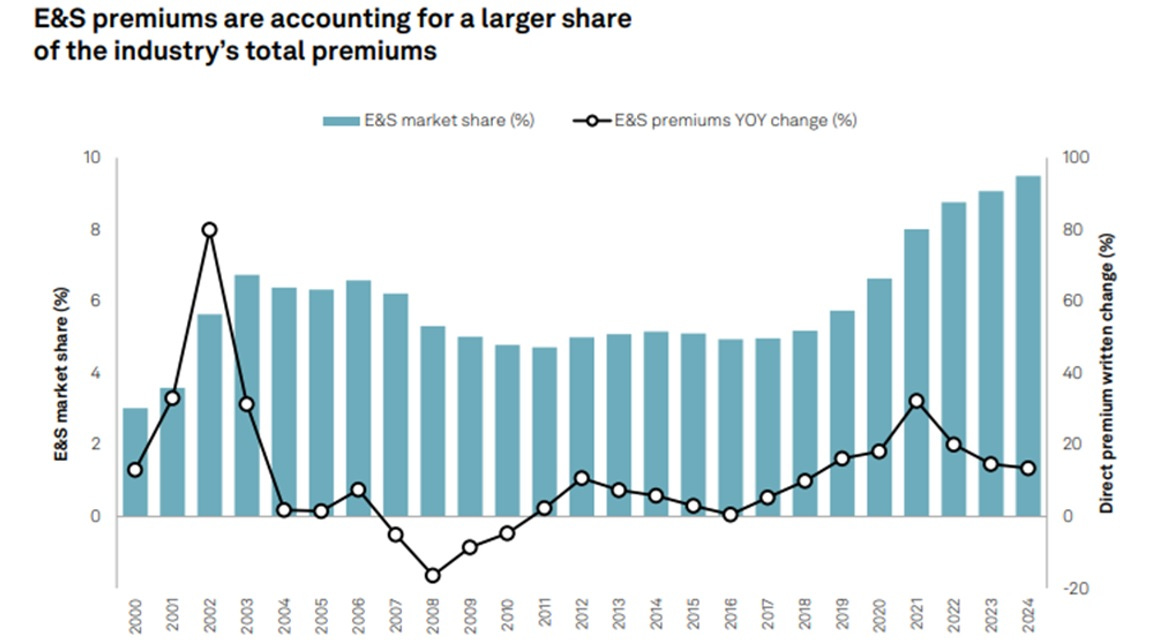

E&S markets have grown steadily over the years and is now a good portion of the total industry:

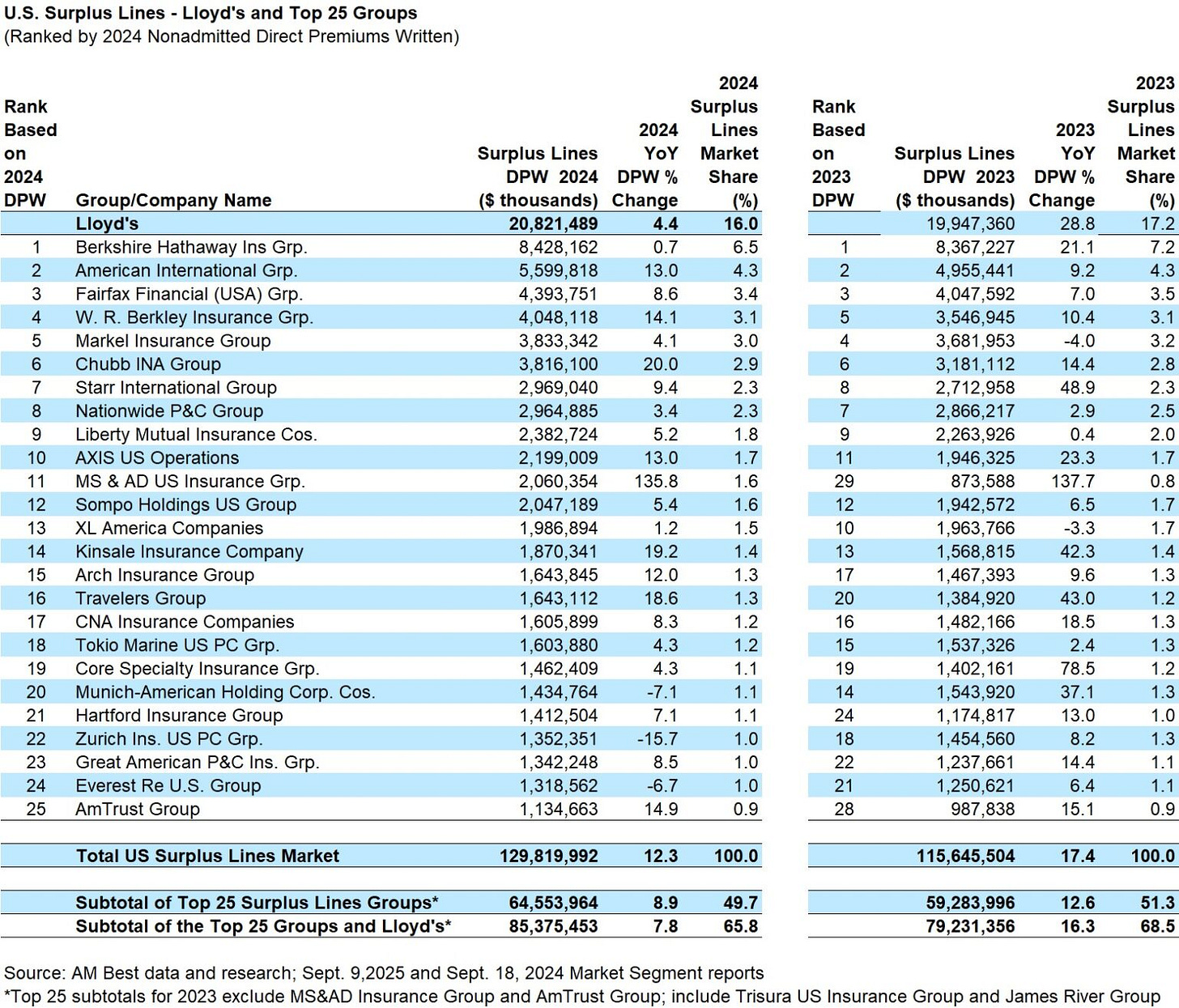

Year 2024 marked the 7th straight year of double-digit growth for the E&S market, the top 25 players write about 2/3 of the total $130b premiums.

For much of the past three decades, the top 25 surplus lines groups, combined with the syndicates comprising the Lloyd’s market, have accounted for more than 70% share.

This declining concentration at the top of the market reveals the impact new market entrants and insurers with expanded surplus lines focused strategies. Not surprisingly, the 7 years continuous profitability have drawn capital into E&S, diluting the market share of big players.

Berkshire remains the largest E&S underwriter. It's worthy to note that Berkshire is currently the world’s largest insurer by non-banking assets of $1.15t, overthrowing second place Allianz of $1.09t.

On the top 5 players, W R Berkley grew E&S direct premiums by the largest 14.1% in 2024.

Underwriting profits also remained superior to the overall P&C industry. E&S insurers recorded a combined ratio of 88% in 2024, compared with 95% for the broader market.

Although this was modestly weaker than the 86% achieved in 2023, profitability remains far ahead of the 5-year E&S average of 97%.

Property lines were particularly profitable, with a combined ratio of 67%, compared with 103% for casualty. This was the third straight year in which the E&S segment outperformed the industry in underwriting profitability.

All these good stats come at no surprise as the industry has been in a hard market since 2019. The insurance industry is cyclical and E&S isn't exempt. As new capital comes in, we should expect softer pricing conditions and profitability to narrow.

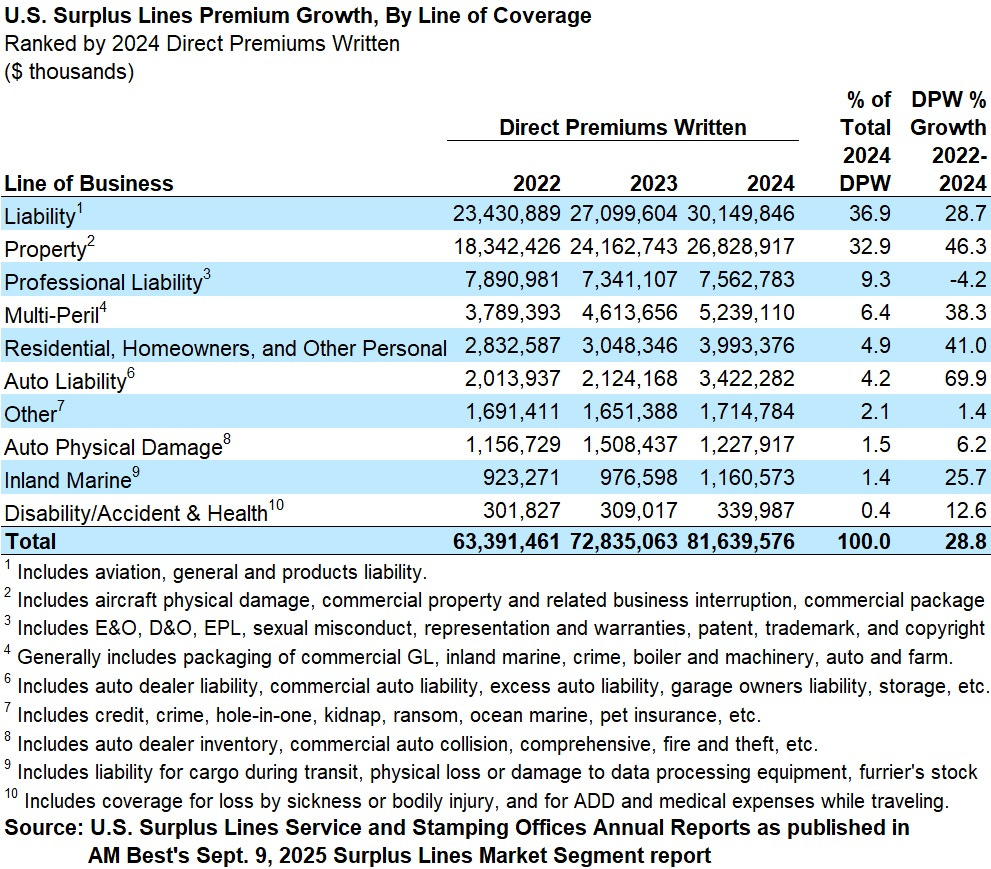

Products Breakdown

Even though the US homeowners insurance segment remains a relatively small part of the overall E&S market, increased climate risk has fueled growth in this business line. Along with the higher cost of raw materials to repair or rebuild homes and supply chain slowdowns, we have seen more homeowners’ business seeking E&S insurers.

The only lines with bigger premium jumps were commercial auto liability and commercial property. If we check their combined ratios on overall P&C basis, they are actually making underwriting losses on 5 and 10-years time frames.